The global Cocoa Butter Equivalent (CBE) market supplies cost-effective and performance-oriented alternatives to cocoa butter for use in chocolate, confectionery, bakery fats, and cosmetics. CBEs — typically formulated from vegetable fats such as palm oil fractions, illipe, shea stearin, or interesterified blends — mimic key functional characteristics of cocoa butter (melting profile, snap, mouthfeel) while helping manufacturers manage costs, improve processing, and meet formulation needs.

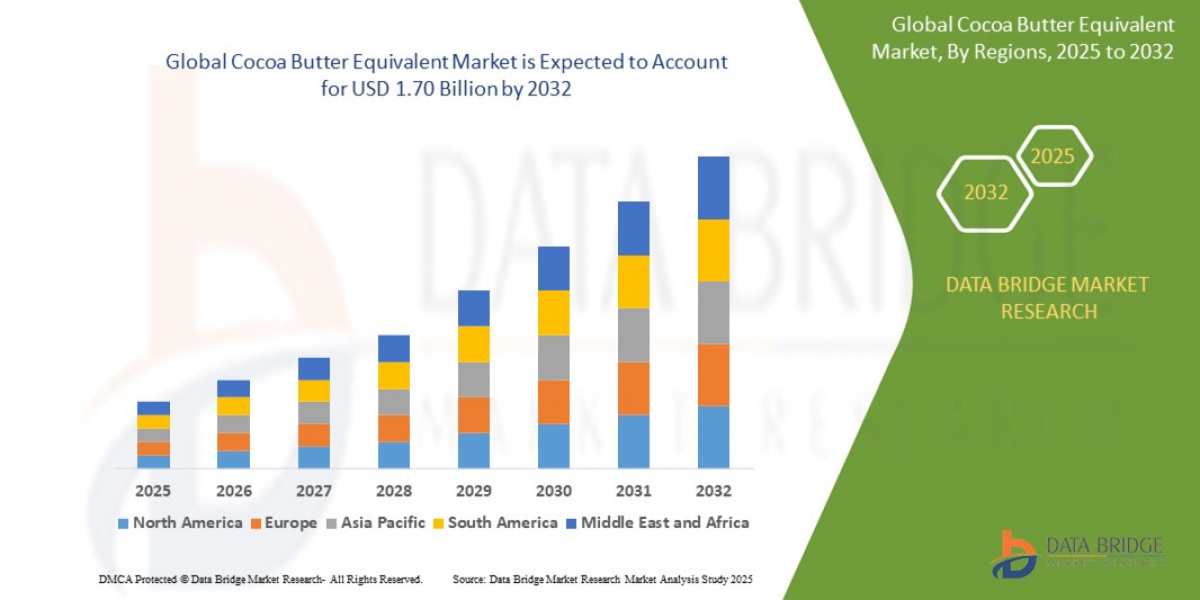

The global cocoa butter equivalent market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.70 billion by 2032, at a CAGR of 4.06% during the forecast period

Market Overview

CBE materials are specialty vegetable fat blends engineered to match the physical and melting characteristics of cocoa butter. They are widely used where manufacturers seek to reduce raw-material costs, tailor crystallization behavior, or improve shelf stability. While cocoa butter remains the premium ingredient for high-end chocolate, CBEs play a vital role in mainstream confectionery, compound coatings, bakery fillings, and certain cosmetic formulations where price-performance trade-offs are acceptable.

Key Market Drivers

Cocoa price volatility and cost control: Fluctuations in cocoa butter prices encourage manufacturers to use CBEs to stabilize costs and protect margins.

Growing demand for affordable chocolate products: Mass-market confectionery and compound coatings rely on CBEs to offer lower-cost alternatives while maintaining acceptable sensory profiles.

Processing and functionality advantages: CBEs can be optimized for specific processing needs (shorter tempering times, modified melting points) and provide better stability under warm storage conditions.

Expansion of bakery and confectionery sectors in emerging markets: Rising disposable income and snacking culture drive demand for affordable chocolate-containing goods that commonly use CBEs.

Cosmetics and personal care applications: Certain CBEs are used in creams and balms as emollients or texture modifiers where cocoa butter-like properties are desirable at a lower cost.

Market Segmentation

By Feedstock / Type:

Palm oil fraction-based CBEs (largest share historically)

Shea stearin and shea blends

Illipe/Sal-based blends

Coconut oil blends

Interesterified custom blends (tailored melting profiles)

By Form:

Solid stearins / butters

Liquid fractions / oleins

Pre-blended pastilles / slabs

By Application:

Chocolate and compound coatings

Bakery fillings and icings

Confectionery (bars, enrobed products)

Cosmetic & personal care formulations

Industrial food processing

By Region:

Asia-Pacific (fastest-growing demand for mass-market confectionery)

Europe (large chocolate industry with premium and compound segments)

North America (significant confectionery and bakery markets)

Latin America, Middle East & Africa (emerging and price-sensitive segments)

Industry Trends

Sustainability and certification focus: Demand for RSPO-certified palm fractions and sustainably sourced shea is rising as buyers and consumers scrutinize environmental and social footprints.

Customized interesterified blends: Manufacturers increasingly commission interesterified fats to replicate cocoa-butter-like polymorphism and mouthfeel while controlling slip melting points and tempering behavior.

Clean-label and “natural” positioning: Some confectionery brands seek CBEs derived from recognizable plant sources (shea, coconut) to fit clean-label narratives, even if cost is higher.

Supply-chain vertical integration: Fat and oil refiners expanding into finished fat blends and pre-formulated CBEs to offer turnkey solutions and consistent quality.

Technological advances in fat fractionation: Better fractionation and hydrogenation-free processes improve yield of desirable stearins and oleins that feed into higher-performance CBEs.

https://www.databridgemarketresearch.com/reports/global-cocoa-butter-equivalent-market

Challenges

Regulatory and labeling restrictions: Country-specific rules on cocoa content and labeling can limit CBE use in products marketed as chocolate in some jurisdictions. Manufacturers must navigate compositional standards and consumer-protection regulations.

Consumer perception and premiumization: Premium chocolate consumers often prefer pure cocoa-butter products; rising premiumization can constrain CBE uptake in upscale segments.

Raw material price and availability: Dependence on palm-based feedstocks exposes CBE makers to palm price swings and sustainability-related supply risks. Shea and other specialty feedstocks can be seasonal and regionally constrained.

Technical performance gap: While CBEs have improved, matching the complex melting and crystallization behavior of 100% cocoa butter—especially for high-quality filled chocolates—remains technically challenging.

Future Outlook

The Global CBE Market is expected to maintain steady growth driven by price-sensitive confectionery demand, expanding bakery and processed-food sectors in developing regions, and continued interest from cosmetics formulators seeking cost-effective emollients. Growth will be strongest where large-scale mass-market chocolate and compound coatings dominate (Asia-Pacific, parts of Latin America). Suppliers who can offer sustainably sourced, certified feedstocks and customizable, hydrogenation-free blends with reliable polymorphic behavior will be best positioned. Additionally, regulatory clarity and transparent labeling—coupled with improved consumer education about ingredient roles—may broaden acceptable CBE use.

Browse More Reports:

Global Beverage Cans Market

Asia-Pacific Functional Mushroom Market

Global Acoustic Emission Testing Market

Global 5-Aminolevulinic Acid Hydrochloride (ALA) Market

Global Air Filters Market

Global Oilfield Biocides Market

Global Connected Packaging Market

Global Artificial Intelligence - Based Magnetic Resonance Imaging (MRI) Market

Global Body Dryer Market

Europe Predictive Maintenance Market

Europe FTTH GPON Market

Europe Automated Liquid Handling Market

Global Gluten-Removed Products Market

Global Horizontal Directional Drilling Market

Global Fatty Alcohols Market

Conclusion

Cocoa Butter Equivalents will remain a strategic ingredient for manufacturers balancing cost, functionality, and stability. While premium chocolate sectors favor pure cocoa butter, CBEs serve an important complementary role across mainstream confectionery, bakery, and certain personal-care applications. The market’s future will be shaped by sustainability commitments, technical advances in fat engineering, and the evolving preferences of consumers and global food brands.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com