I. Introduction: Decoding Your Blood Sugar – A Modern Marvel

Diabetes. The very word conjures images of a life dictated by needles and dietary restrictions. Affecting hundreds of millions worldwide, it's a silent epidemic, a constant companion demanding unwavering vigilance. But within this narrative of constraint lies a story of ingenuity, of devices that have transformed the way we understand and manage this condition. Glucose meters, those unassuming little gadgets, are more than just number-spitting machines; they are lifelines, empowering individuals to take control of their health in ways unimaginable just decades ago.

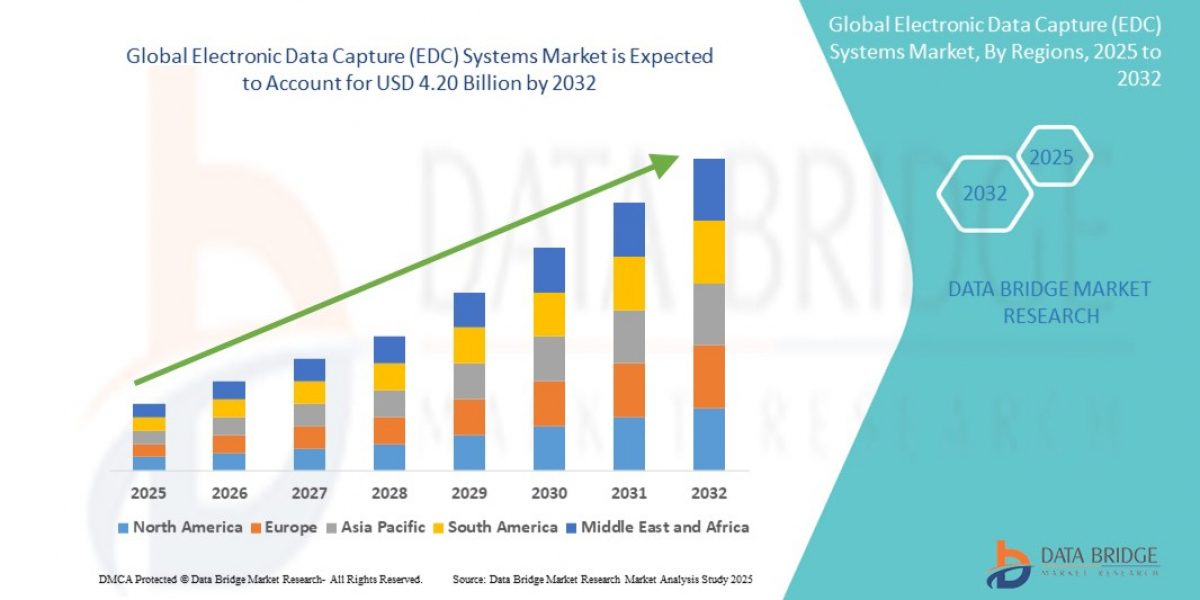

Consider the scope: this seemingly niche market is a multi-billion dollar behemoth, projected to explode in the coming years. Why? Because at its core, it speaks to a fundamental human desire: the yearning for agency over our own bodies, the right to understand the language of our physiology.

The global glucose meters market size was valued at USD 12.71 billion in 2024 and is expected to reach USD 27.65 billion by 2032, at a CAGR of 10.20% during the forecast period

II. A Blast from the Past: The Not-So-Sweet History of Sugar Tracking

Let's take a moment to appreciate how far we've come. Imagine, if you will, the "olden days" of diabetes management. Forget sleek digital displays; we're talking about meticulously collecting urine samples and performing rudimentary chemistry experiments. Benedict's solution, Clinitest tablets – names that evoke images of bubbling beakers and questionable accuracy. These were the tools, the arcane rituals, of blood sugar tracking.

Then came the Dextrostix in 1965, a "breakthrough" that involved a color-changing strip, a messy wash-off, and a subjective comparison to a printed chart. Progress, yes, but hardly elegant.

The real turning point arrived in the early 1970s with the first actual meter, the Ames Reflectance Meter. A clunky, expensive piece of equipment, it was a far cry from the pocket-sized devices we know today. However, it paved the way for the first battery-operated, home-use monitor in 1979, driven by the motivation of a father for the health of his daughter. Self-monitoring, a concept previously confined to the clinical laboratory, was finally within reach.

The 1980s and 90s witnessed a miniaturization revolution. Meters shrank, costs decreased, and the required blood sample dwindled to a mere droplet. No more wiping blood from the strip, now technology reads the sample itself.

III. Today's Tech Triumphs: What's Hot in Glucose Monitoring Right Now

Today, we stand at the crossroads of established technology and groundbreaking innovation. The traditional Self-Monitoring Blood Glucose (SMBG) method, the trusty finger-prick, remains a cornerstone. Affordable, easy to use, and still essential, especially in emerging markets, it provides a snapshot of blood sugar levels at a specific moment in time. The underlying science is a marvel of miniaturization: a tiny drop of blood interacts with an enzyme on the test strip, generating an electric current proportional to the glucose concentration. Elegant in its simplicity.

But the real excitement lies with Continuous Glucose Monitoring (CGM) systems. These "new kids on the block" are rapidly transforming diabetes management. Imagine having access to real-time glucose readings, day and night, without the constant need for finger pricks. CGMs provide a continuous stream of data, offering insights into glycemic trends, potential highs and lows, and the impact of food, exercise, and stress on blood sugar levels.

The benefits are undeniable: improved HbA1c levels, fewer painful finger pricks, proactive alerts for dangerous glucose excursions, and a more comprehensive understanding of one's metabolic profile. These wearable wonders, small sensors typically worn on the arm, transmit data wirelessly to a smartphone or dedicated receiver.

The adoption of these technologies spans the spectrum of diabetes, from Type 1 to Type 2 (representing a staggering 80% of the market), gestational diabetes, and across both home care and hospital settings. The market, unsurprisingly, is booming, with North America currently leading the charge and the Asia-Pacific region experiencing explosive growth.

IV. The Sticky Side: Controversies, Headaches, and Hurdles

However, the path to technological utopia is rarely smooth. Let's acknowledge the "sticky side" of glucose monitoring – the controversies, headaches, and persistent challenges that continue to plague the field.

Accuracy, or rather the perception of accuracy, is a perennial concern. While manufacturers adhere to strict regulatory guidelines, the reality is that variability exists. FDA has expressed concerns regarding strip variability, lot-to-lot differences, and the influence of external factors such as medications and oxygen levels.

And then there's the "human factor." User error, whether unintentional or deliberate, remains a significant source of inaccurate readings. Even intentional misreporting, whether driven by shame or a desire to please healthcare providers, can skew the data and hinder effective management.

The emergence of Over-The-Counter (OTC) CGMs has sparked a fierce debate. Proponents tout the democratization of data, the potential for individuals to gain insights into their metabolic responses to various stimuli, and the possibility of earlier diabetes detection. But critics raise concerns about potential misinterpretations of data, increased anxiety, the risk of misdiagnosis, and even the development of disordered eating patterns. Is this technology truly necessary for individuals who are not on insulin therapy?

Cost remains a formidable barrier. Advanced technology often translates to advanced prices, limiting access for many, especially in low- and middle-income countries. Reimbursement policies, often complex and inconsistent, further complicate matters.

And let's not forget the "tech tantrums" – Bluetooth connectivity issues, lost signals, incessant alarms, and skin irritation caused by adhesives. Technology, for all its sophistication, is not immune to glitches and frustrations.

Finally, stricter regulations and manufacturing hiccups can lead to product recalls, slowing market growth and eroding consumer confidence.

https://www.databridgemarketresearch.com/reports/global-glucose-meters-market

V. Crystal Ball Gazing: The Future of Glucose Monitoring

Despite these challenges, the future of glucose monitoring is brimming with potential. The "holy grail," of course, is non-invasive monitoring – the elimination of finger pricks altogether. Researchers are actively exploring a range of technologies, including optical sensors, radio waves, and thermal sensors, to achieve this elusive goal.

The promise is tantalizing, but the reality is that non-invasive glucose monitoring remains a formidable technical challenge.

Beyond non-invasive techniques, the focus is on creating smarter, faster, and more connected devices. Artificial intelligence (AI) is poised to revolutionize diabetes management, providing personalized insights, predicting glucose levels, and seamlessly integrating with other health devices.

Wearable technology will become even more ubiquitous, with glucose monitoring capabilities embedded in smartwatches, fitness trackers, and even clothing.

The "artificial pancreas," a closed-loop system that combines a CGM with an insulin pump to automatically adjust insulin delivery, is already a reality. These systems, such as the Omnipod 5 and Tandem Control-IQ, represent a paradigm shift in diabetes management, liberating individuals from the burden of constant manual adjustments.

Sensors will last longer, require less maintenance, and provide a more comprehensive picture of metabolic health. The Dexcom G7 (15-day wear) and FreeStyle Libre (14-day wear) are already pushing the boundaries of sensor longevity, and the need for manual calibrations is rapidly becoming a thing of the past.

Furthermore, glucose monitoring is evolving into a broader health monitoring platform, tracking other vital parameters alongside blood sugar.

Finally, keep an eye out for new and innovative products such as the Dexcom Stelo (OTC CGM for non-insulin users), Senseonics Eversense 365 (a 1-year implantable CGM), and Abbott's wellness-focused Lingo, which promise to further expand the horizons of glucose monitoring.

Browse More Reports:

Europe Walk-In Refrigerators and Freezers Market

Europe Session Initiation Protocol (SIP) Trunking Services Market

Middle East and Africa Predictive Maintenance Market

Europe Functional Mushroom Market

North America Functional Mushroom Market

North America Automated Liquid Handling Market

Global Hyperbaric Oxygen Therapy (HBOT) Market

Global Digital Forensics Market

Global Functional Mushroom Market

Global Electron Microscope Market

Global Track and Trace Solutions Market

Global Mass Spectrometry Market

Global Tallow Market

Global Atherosclerosis Market

Global Active, Smart and Intelligent Packaging Market

VI. Conclusion: A Sweet Future Ahead

From rudimentary urine tests to incredibly sophisticated, connected systems, the journey of glucose monitoring has been nothing short of remarkable. These devices have empowered millions to take control of their health, making life with diabetes easier, healthier, and more fulfilling.

Challenges remain – cost, accuracy, data interpretation – but innovation is relentless. The future of diabetes management looks brighter, sweeter, and a whole lot smarter.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com