Tactical Communication Systems (TCS) Market — Industry Outlook & Report

Executive summary

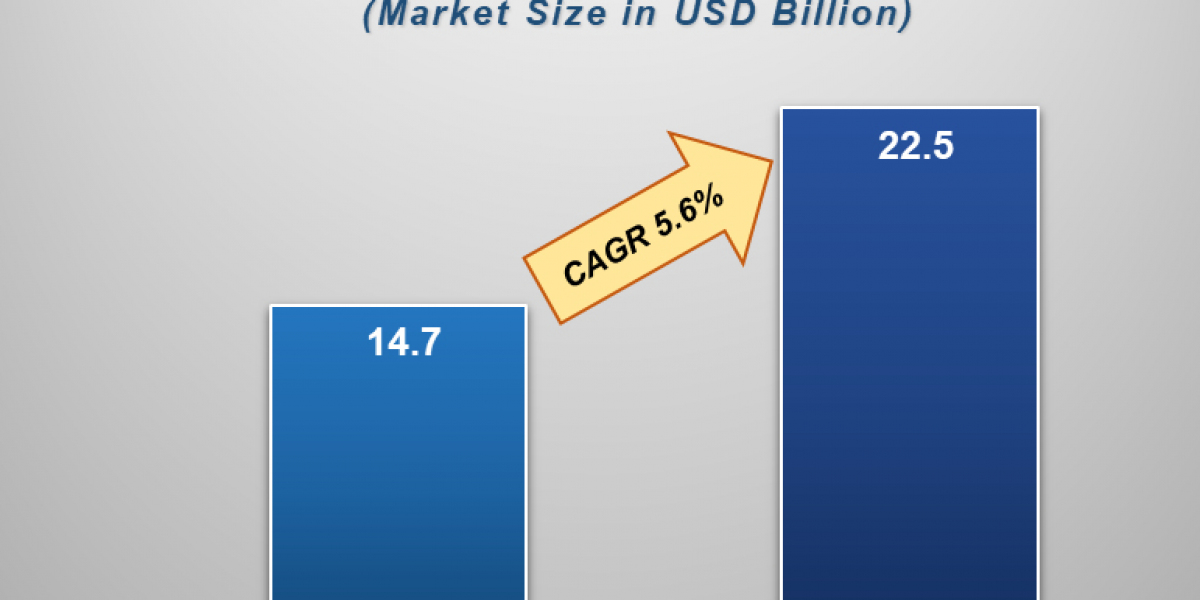

The Tactical Communication Systems (TCS) Market is anticipated to experience substantial growth from 2025 to 2033, fuelled by increasing demand for electric vehicle fuel market growth. With an estimated valuation of approximately USD 14.7 billion in 2025, the market is expected to reach USD 22.5 billion by 2033, registering a robust compound annual growth rate (CAGR) of 5.6% over the decade.

Know More About Tactical Communication Systems (TCS) Market Download Sample Report : https://m2squareconsultancy.com/reports/tactical-communication-systems-tcs-market

Purchase a Copy of https://m2squareconsultancy.com/reports/request-free-sample-pdf/ : https://m2squareconsultancy.com/purchase

Market size & forecast (high-level view)

Estimates differ by report methodology, but common themes emerge:

- Several analysts estimate the market at roughly USD 14–21 billion in the mid-2020s (2023–2025), depending on whether adjacent COMINT/ISR and SATCOM segments are included

- Forecasts project growth to anywhere between roughly USD 19–32 billion by the early-to-mid 2030s, with CAGRs typically reported between ~4.5% and ~6.5% (some niche forecasts show higher 7–8% scenarios when rapid SATCOM and software upgrades are assumed). The spread reflects different scope definitions (tactical radios only vs. full systems, services, integration).

(When you need a specific number for slide decks or an executive summary, tell me which forecast window you prefer and I’ll anchor the article to that single source.)

Market drivers

- Defense modernization & higher procurement budgets — many governments are renewing investments in battlefield communications to enable secure, resilient networking across land, air, sea and space.

- Shift to software-defined, networked architectures — SDRs, open architectures (e.g., NATO-STANAG/OSCAL style approaches) and middleware enable rapid capability upgrades and multi-vendor interoperability. This raises service and software spending alongside hardware

- Need for resilient beyond-line-of-sight (BLOS) links — increased use of SATCOM, narrowband/wideband datalinks, and mesh networking for contested environments.

- Integration with ISR, C2 and autonomous systems — tactical communications act as the backbone for UAVs, sensors, and edge compute, creating demand for higher throughput and lower latency.

Restraints & challenges

- Spectrum constraints & regulation — limited RF spectrum and coordination issues slow some deployments.

- Cybersecurity & supply-chain risk — secure cryptographic lifecycles and trusted suppliers are expensive and politically sensitive.

- Interoperability complexity — legacy radios, proprietary waveforms and varying standards complicate integration and drive upgrade cycles.

Market segmentation (typical categories)

- By product: Tactical radios (manpack, handheld, vehicular, airborne), SATCOM terminals, datalinks, networking equipment, software/services (integration, training, maintenance).

- By waveform/technology: VHF/UHF, HF, SDR, LTE/5G private tactical networks, SATCOM (L/S/Ka-band).

- By end-user: Army/land forces, air forces, naval forces, homeland security/public safety.

- By geography: North America (largest spend), Europe (modernization), Asia-Pacific (fastest growth in several forecasts), Middle East & Africa, Latin America.

Trends to watch (2024–2035)

- Convergence of tactical LTE/5G private networks with traditional radio networks for high-data use cases (video, sensor streams).

- Waveform virtualization & cloud-enabled mission apps — treating radios like cloud-managed endpoints to push new capabilities rapidly.

- Focus on resilient mesh & MANET for dispersed forces with degraded infrastructure.

- Commercial SATCOM partnerships — increased use of commercial LEO/MEO constellations to provide assured BLOS comms.

- Services & lifecycle revenue — integration, cybersecurity, and software subscriptions are growing faster than hardware in many forecasts.

Competitive landscape — key players

Market players are a mix of traditional defense primes and specialist communications vendors. Prominent names regularly cited across reports include:

- Thales Group

- L3Harris Technologies / Harris (radio systems & waveforms)

- General Dynamics Mission Systems

- Leonardo S.p.A.

- BAE Systems

- Northrop Grumman

- Raytheon / Collins Aerospace

- Elbit Systems

- Saab, Cobham, Rohde & Schwarz and Motorola Solutions (in public safety / tactical LTE).

- Many vendors are pursuing partnerships (e.g., SATCOM providers, semiconductor/FPGA suppliers, software houses) to accelerate system-level offerings.

Recent developments (examples)

- Increased contract awards for SDR and battlefield networking kit across NATO members and partners.

- Growing M&A and collaboration activity to combine SATCOM, cyber, and networking capabilities with tactical radio platforms.

(For a tailored “recent developments” timeline with dates and contract values I can pull, I can prepare a slide-ready summary anchored to the latest press releases—tell me if you want that.)

Regional snapshot

- North America: largest market share—big procurement programs and fast adoption of software-defined and NATO-interoperable systems.

- Europe: modernization programs and multinational interoperability efforts drive steady demand.

- Asia-Pacific: strong growth expectations driven by defense modernization in India, South Korea, Japan and Southeast Asia.

- Middle East & Africa: spending driven by regional security investments and border/patrol needs.

Outlook & recommendations for suppliers and buyers

- Suppliers should invest in open architectures, waveform portfolios, and services (cyber, training, sustainment). Partnering with commercial SATCOM/5G players can open new BLOS product lines.

- Buyers (defense/public safety) should budget for lifecycle costs (software, updates, crypto), prioritize modular SDRs that can be field-upgraded, and plan spectrum and interoperability testing early in procurement.

Related Reports Links :

https://m2squareconsultancy.com/reports/global-ammunition-market

https://m2squareconsultancy.com/reports/helicopter-market

https://m2squareconsultancy.com/reports/tactical-communication-systems-tcs-market

https://m2squareconsultancy.com/reports/advanced-driver-assistances-ystems

https://m2squareconsultancy.com/reports/shipping-container-market

https://m2squareconsultancy.com/reports/electric-vehicle-battery-case-market

https://m2squareconsultancy.com/reports/recyclable-packaging-market

https://m2squareconsultancy.com/reports/driving-simulator-market

https://m2squareconsultancy.com/reports/automotive-robotics-market

https://m2squareconsultancy.com/reports/water-soluble-fertilizers-market

https://m2squareconsultancy.com/reports/medical-device-packaging-market

https://m2squareconsultancy.com/reports/humanoid-robot-market

https://m2squareconsultancy.com/reports/hybrid-vehicle-market

https://m2squareconsultancy.com/reports/dairy-alternative-products-market

https://m2squareconsultancy.com/reports/hair-serum-market

Reasons to Purchase this Report

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors

- Provision of market value data for each segment and sub-segment

- Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

- Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

- Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major market players

- The current as well as the future market outlook of the industry with respect to recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

- Market dynamics scenario, along with growth opportunities of the market in the years to come

About m2squareconsultancy :

We are a purpose-driven market research and consulting company passionate about turning data into direction. Founded in 2023, we bring together researchers, strategists, and data scientists who believe that intelligence isn’t just about numbers, it’s about insight that sparks progress.

We cater to a wide range of industries by delivering customized solutions, strategic insights, and innovative support that help organizations grow, adapt, and lead in their respective sectors. Here’s a brief overview of key industries we work with

Contact Us:

Email: sales@m2squareconsultancy.com

Phone (IN): +91 80978 74280

Phone (US): +1 929 447 0100