The dry bulk shipping market is one of the most vital pillars of global trade, enabling the transportation of essential raw materials across continents and oceans. Unlike container shipping that focuses on finished products or packaged goods, dry bulk shipping deals with unpackaged commodities such as coal, iron ore, grains, bauxite, fertilizers, and other raw materials that serve as the foundation of many industries. This sector plays an integral role in connecting producers with manufacturers and consumers, making it a key element in the functioning of the global economy.

The demand for dry bulk shipping is closely tied to industrialization, energy consumption, and agricultural production. As nations continue to develop, the need for steel, electricity, construction materials, and food grains continues to expand, creating a consistent requirement for vessels capable of transporting bulk goods in large volumes. Iron ore and coal dominate the segment, accounting for a major share of shipments, as they remain the backbone of energy generation and steel production. Additionally, the trade of agricultural commodities such as wheat, corn, and soybeans has been on the rise, reflecting the growing population and rising food demand worldwide.

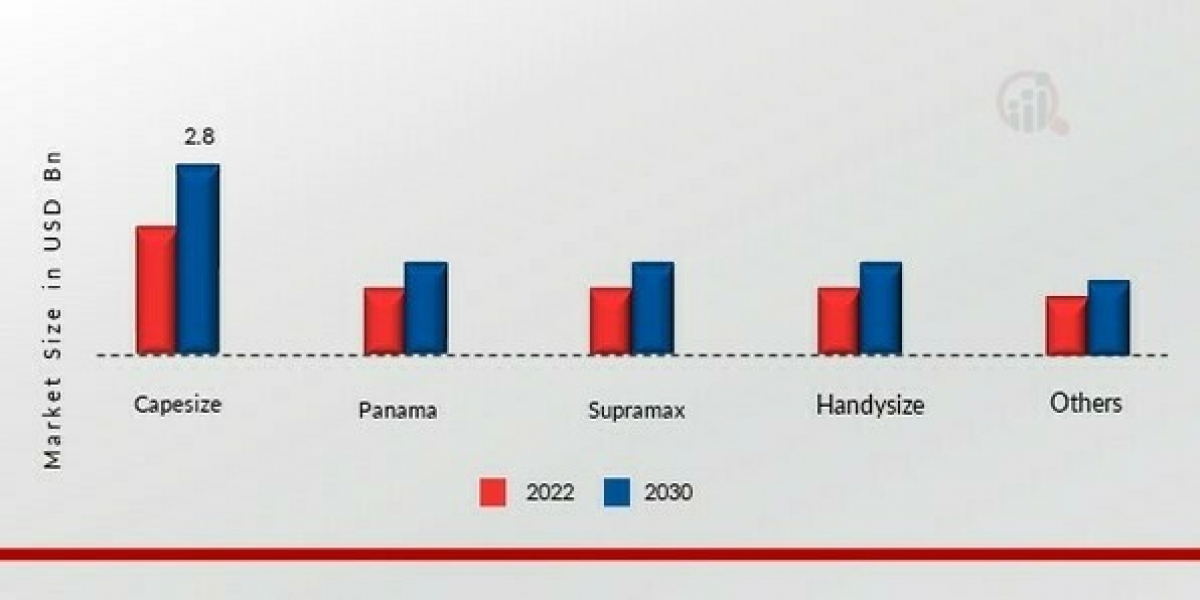

Fleet composition in the dry bulk shipping market is categorized based on vessel size. The Capesize vessels, as the name suggests, are too large to pass through the Panama or Suez Canals and typically transport iron ore and coal between major producing and consuming nations. Panamax vessels are designed to fit within the locks of the Panama Canal and are commonly used for transporting grains and minor bulks. Supramax and Handysize vessels, being smaller, offer greater flexibility, enabling access to smaller ports and facilitating diversified routes. This segmentation allows the market to cater to different trade needs, ensuring efficiency across global supply chains.

The market is highly sensitive to global economic cycles. When economies expand, construction, energy, and industrial activities surge, which in turn boosts demand for dry bulk commodities. This leads to higher shipping activity and rising freight rates. Conversely, during economic downturns, the demand for raw materials contracts, causing shipping companies to face challenges in sustaining profitability. The cyclical nature of the industry makes it volatile but also offers opportunities for strong growth during upswings.

Another critical factor influencing the dry bulk shipping market is the balance between fleet capacity and trade demand. Overcapacity has historically been a challenge, as the delivery of too many new vessels often results in downward pressure on freight rates. Shipping companies and investors are therefore cautious when placing new orders, as fleet expansion needs to align with anticipated demand growth. The process of shipbuilding itself is lengthy and capital-intensive, adding further complexity to capacity management.

Geographically, the Asia-Pacific region is at the center of dry bulk shipping, largely driven by China’s massive appetite for raw materials. China remains the largest importer of iron ore and coal, with its infrastructure development, steel production, and power generation industries continuously fueling demand. India is also emerging as a significant contributor, both as an importer of coal and agricultural commodities and as an exporter of iron ore. Other regions such as Europe and North America maintain steady participation in the market, largely through agricultural exports and energy resource imports, while emerging economies in Africa and South America provide abundant raw materials for global consumption.

Sustainability is becoming an increasingly important aspect of the dry bulk shipping market. The shipping industry as a whole is under pressure to reduce emissions and comply with international environmental regulations. Shipowners are investing in fuel-efficient designs, alternative fuels, and retrofitting older vessels with technologies that lower emissions. The push for greener practices is expected to reshape the industry over the coming years, as compliance with environmental standards will influence competitiveness and operational strategies.

Digitalization is another transformative trend in this sector. The adoption of advanced data analytics, real-time monitoring, and automation is enabling shipping companies to optimize routes, enhance fuel efficiency, and improve safety standards. Smart shipping solutions are allowing operators to predict maintenance needs, reduce downtime, and improve overall operational efficiency. This integration of technology is gradually modernizing an industry traditionally seen as conservative and labor-intensive.

The financial landscape of the dry bulk shipping market is also shaped by fluctuating freight rates, commonly measured by indices such as the Baltic Dry Index. These rates determine the profitability of operators and serve as indicators of global trade health. Investors, shipping companies, and traders monitor these movements closely, as even small fluctuations in freight rates can significantly impact revenues and profitability. Strategic long-term contracts, hedging mechanisms, and charter agreements are often employed to mitigate risks associated with rate volatility.