The chlor alkali market stands as one of the most vital pillars of the global chemical industry, playing a crucial role in manufacturing a wide range of essential industrial and consumer products. This market revolves around the production of three key chemicals—chlorine, caustic soda (sodium hydroxide), and soda ash (sodium carbonate)—which form the foundation for numerous downstream sectors such as paper and pulp, textiles, water treatment, detergents, and petrochemicals. The market continues to expand steadily due to its indispensable applications and growing demand across both developed and developing economies.

The chlor alkali process, primarily the electrolysis of salt (sodium chloride) solution, produces chlorine and caustic soda as co-products. Over the years, the industry has evolved from traditional mercury cell and diaphragm cell technologies to more energy-efficient and environmentally friendly membrane cell processes. This shift not only minimizes environmental impact but also enhances production efficiency, making the chlor alkali market more sustainable and competitive on a global scale.

One of the primary factors driving market growth is the increasing demand for caustic soda, which is extensively used in industries like alumina, soap and detergent manufacturing, and pulp and paper. The strong expansion of these industries, especially in Asia-Pacific regions such as China and India, has significantly boosted the consumption of caustic soda. Moreover, rapid industrialization and urbanization have led to higher water treatment needs, which in turn have amplified the demand for chlorine. Chlorine is widely used in disinfecting drinking water, treating wastewater, and producing polyvinyl chloride (PVC), an essential material in construction and infrastructure projects.

The chlor alkali market also benefits from its deep integration with the energy and materials sectors. For instance, chlorine is a critical input in the production of PVC, which is used in pipes, cables, flooring, and various building materials. The construction boom in emerging economies continues to stimulate demand for PVC, consequently driving chlorine consumption. Similarly, caustic soda’s role in alumina refining directly connects the chlor alkali market with the global aluminum industry. As the demand for lightweight materials in the automotive and aerospace sectors rises, so does the need for alumina and, by extension, caustic soda.

Despite these strong growth drivers, the chlor alkali market faces several challenges. Environmental regulations concerning chlorine handling, mercury cell processes, and energy consumption have tightened over the years. Manufacturers are compelled to adopt cleaner technologies to comply with stringent government standards. While this transition demands significant capital investment, it also opens opportunities for innovation in process optimization and renewable energy integration. Energy efficiency has become a key priority since electricity costs account for a substantial portion of production expenses in chlor alkali manufacturing. Companies focusing on reducing energy intensity through advanced electrolytic systems are gaining a competitive edge.

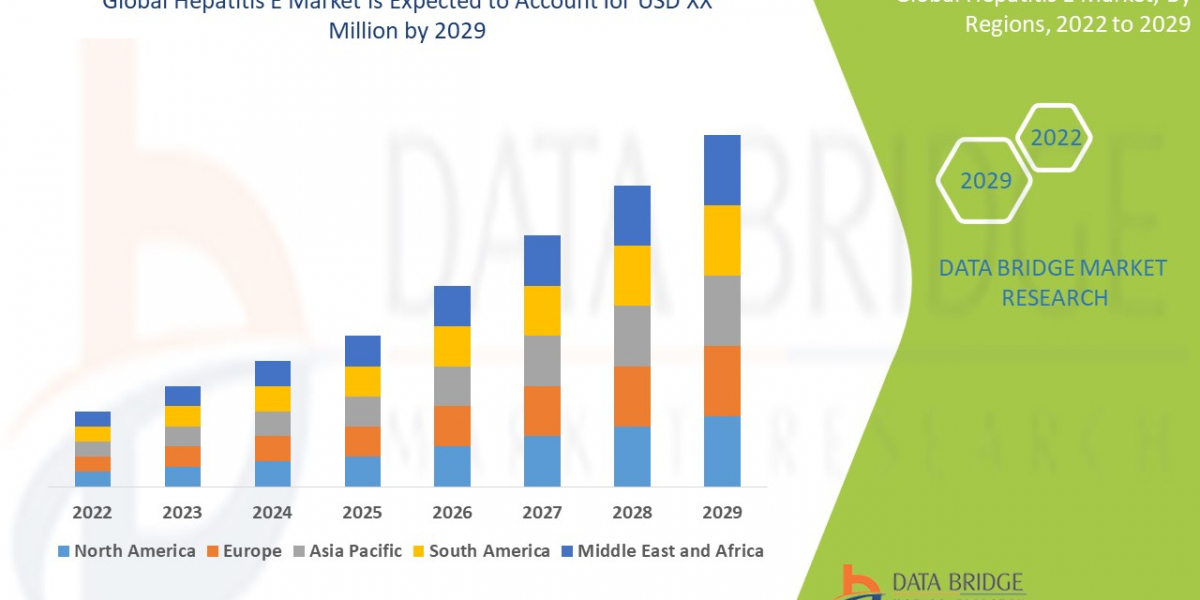

Geographically, the Asia-Pacific region dominates the global chlor alkali market, holding the largest share in terms of production and consumption. China, India, Japan, and South Korea are among the leading producers, benefiting from strong domestic demand and export opportunities. The region’s robust industrial base, expanding infrastructure sector, and abundant availability of raw materials contribute to its leadership. North America and Europe follow closely, where established players are focusing on technological upgrades and sustainable manufacturing. However, in these mature markets, growth is relatively slower due to market saturation and environmental constraints. On the other hand, the Middle East and Africa are emerging as new frontiers, with increasing investments in chemical manufacturing and water treatment projects.

The future outlook of the chlor alkali market appears promising, with technological advancements paving the way for greener and more cost-effective production. The shift toward renewable energy sources for electrolysis and the development of closed-loop systems for waste management are reshaping the industry landscape. Additionally, the integration of digital technologies such as process automation, data analytics, and real-time monitoring systems is improving plant efficiency and operational safety. These innovations not only enhance profitability but also align with global sustainability goals.

Market dynamics are also influenced by the cyclical nature of end-use industries. For instance, fluctuations in construction activity or manufacturing output directly impact chlorine and caustic soda consumption. Moreover, global trade policies, raw material availability, and energy prices play critical roles in determining market stability. The volatility of natural gas and electricity prices can affect production costs, prompting companies to explore alternative energy solutions or long-term contracts for energy procurement.